Employers

Annual Medicare Part D reporting is required for all employers who provide health benefits with prescription drug coverage. The reporting is an online filing to the Centers for Medicare & Medicaid Services (CMS), and it lets CMS know if the prescription drug coverage available on the employer’s health plan is “creditable.”

The Affordable Care Act (ACA) created a research institute known as the Patient-Centered Outcomes Research Institute (PCORI). The goal of PCORI is to help patients and those who care for them make better-informed decisions about healthcare choices. PCORI is funded in part by fees which are charged to health plans.

Last year, the State of Illinois passed a law called the Consumer Coverage Disclosure Act (CCDA). The CCDA requires a written disclosure to be provided by every employer who has employees in the State of Illinois and who also provides group health insurance coverage to those employees.

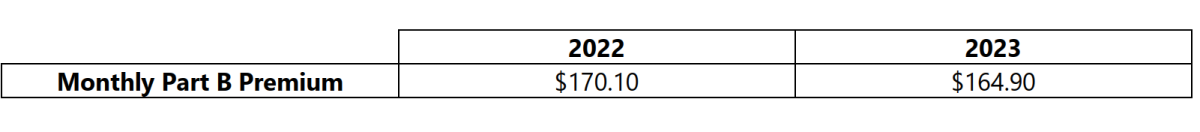

On September 27, 2022, the Centers for Medicare & Medicaid Services released the 2023 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2023 Medicare Part D income-related monthly adjustment amounts. Below is a summary of those numbers:

Advanced Premium Tax Credits (APTCs)

The COVID-19 national emergency was set to expire on July 15, 2022; however, a 90-day extension of the national emergency was issued, and the national emergency is now set to expire on October 13, 2022 (absent another extension).