Producers

Earlier this year, the Centers for Medicare & Medicaid Services (CMS) published some new compliance rules that will impact Third-Party Marketing Organizations (TPMOs) who sell Medicare Advantage and/or Part D plans.

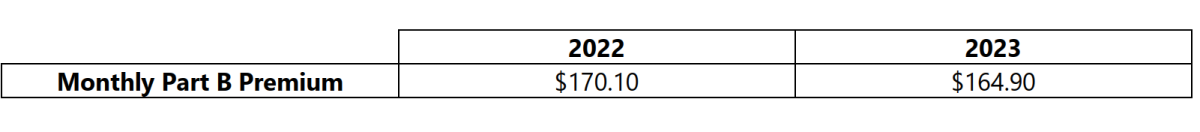

On September 27, 2022, the Centers for Medicare & Medicaid Services released the 2023 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2023 Medicare Part D income-related monthly adjustment amounts. Below is a summary of those numbers:

Advanced Premium Tax Credits (APTCs)

The COVID-19 national emergency was set to expire on July 15, 2022; however, a 90-day extension of the national emergency was issued, and the national emergency is now set to expire on October 13, 2022 (absent another extension).

The Consolidated Appropriations Act of 2021 included a provision that requires brokers and consultants to disclose all direct and indirect compensation they expect to receive for group health plans. The disclosure is required when compensation is expected to be $1,000 or more, and the disclosure must be made prior to any contracts entered into, renewed, or extended on or after December 27, 2021. The disclosure requirements are now in effect.

Overview

Health Reimbursement Arrangements (HRAs) are self-funded group health plans that provide tax-free reimbursements to employees and their family members for out-of-pocket healthcare expenses.